What should you do with an old 401(k)?

So you've recently decided to take a big step and transition to a new job. Good news! Those assets that you’ve invested in your former employer's 401(k) savings plan aren't just gone to waste. In fact, assets invested in a 401(k) retirement plan are often portable when you leave a job. But what should you do with them? There are several factors to keep in mind when considering a 401(k) rollover. Consider which option is right for you:

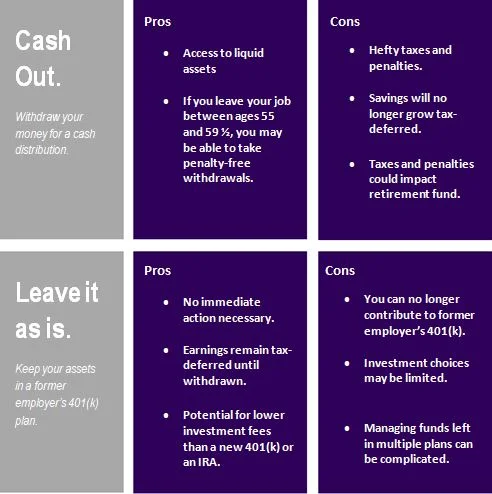

1. Cash Out.

Liquidating your assets for a cash distribution is an option that provides funds in the short term. However, it is important to note that your cash distribution will be subject to state and federal taxes and, before age 59 1/2, a 10% withdrawal penalty may apply. Also, your money loses the potential of growing tax-deferred.

2. Stay in your old workplace plan.

If permitted, leaving your 401(k) plan eliminates the need to make an immediate decision about where to move your savings. Choosing this option lets you continue tax-deferred growth potential; however your account stays subject to your former employer's plan rules, including investment choices and withdrawal options.

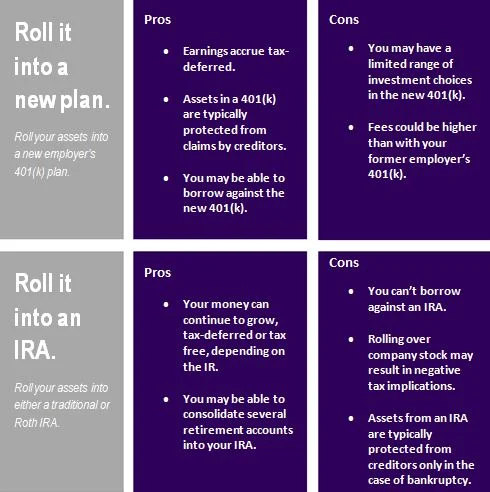

3. Roll over to a new workplace plan.

If you're starting a new job, you may be able to consolidate your 401(k)s into one account while continuing tax-deferred growth potential. This is a good option if your prefer your new plan's features, costs, and investment choices.

4. Roll over to a Traditional or Roth IRA.

Moving your savings into an Individual Retirement Account allows your plan to continue its tax-advantaged status and growth potential for retirement. By moving your assets to an IRA, you gain access to more investment options and have more control over the account.

You should consider all of your options before making a decision, and can use the information provided below to help. We can help you weigh your options so that you can make the right decision for your specific needs.

Think that a rollover is the right decision for you? Contact us and one our specialists will help you carry out the steps to ensure the security of your savings.